The Apple Card savings account is revolutionizing the way users manage their finances by offering a competitive 4.15% APY, a figure that outshines many traditional banks. Designed for Apple Card users, this high-yield savings account allows individuals to seamlessly funnel their Apple Card Daily Cash rewards into an interest-bearing account. In today’s financial landscape, interest rate comparison is crucial, and Apple’s offering stands out as one of the best savings accounts currently available. This initiative marks a significant expansion of Apple financial services, emphasizing their commitment to enhancing user experience and financial wellness. With the potential to earn more than traditional banking options, this new feature could reshape how customers view their cash reserves.

Introducing the Apple Card savings account, a modern solution designed to elevate your savings game. By combining everyday cash rewards with a lucrative high-interest account, Apple empowers you to maximize your earnings effortlessly. This innovative savings tool is positioned as one of the most attractive options on the market today, urging users to reconsider how they store their money. Apple’s drive into financial products is not just about convenience but also about offering competitive returns that can significantly benefit users. With features tailored for the Apple ecosystem, this product ushers in a new era of financial management for tech-savvy consumers.

Understanding the Apple Card Savings Account

Apple has introduced a new high-yield savings account designed specifically for Apple Card users, allowing them to maximize their financial rewards effortlessly. With an impressive 4.15% annual percentage yield (APY), this savings account stands out as a lucrative alternative to traditional banks where rates often languish around 0.01% APY. This new feature is not only about earning higher interest; it’s a simple and efficient way for users to manage and grow their Apple Card Daily Cash rewards.

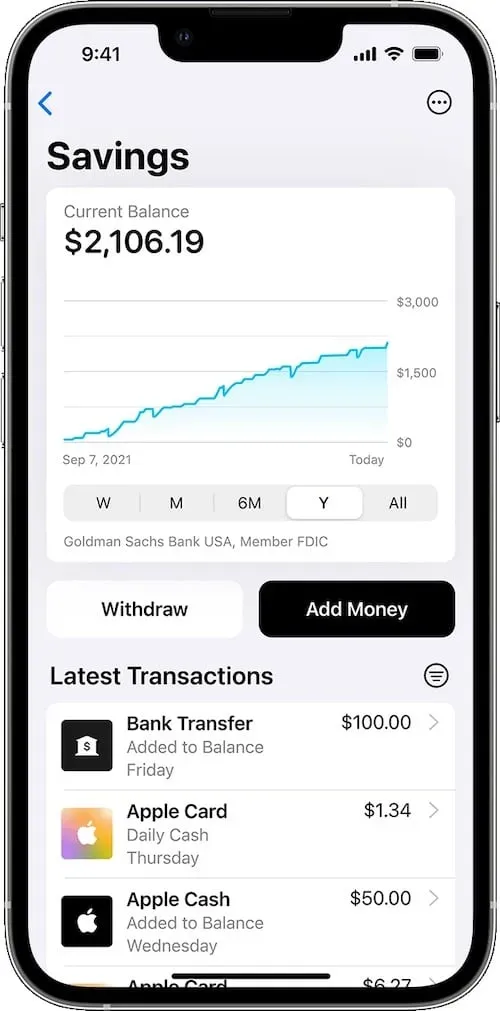

By integrating the savings account directly into the Wallet app on iPhones, Apple is creating a seamless experience for users who want to save their cashback rewards efficiently. The ability to deposit funds not just from Daily Cash but also from external bank accounts makes it incredibly user-friendly. This innovation signifies Apple’s commitment to expanding its financial services and offers users a smart way to enhance their savings while utilizing the Apple ecosystem.

The Benefits of High-Yield Savings Accounts

High-yield savings accounts have gained popularity due to their potential for offering better returns compared to traditional savings accounts. The Apple Card’s new offering is a prime example of this trend, featuring a competitive APY that significantly enhances the earning potential of users’ saved money. While other banks may offer lower rates, Apple’s approach allows customers to capitalize on their everyday spending and turn those rewards into meaningful savings.

In addition to higher interest rates, users benefit from the flexibility of the Apple Card savings account. Unlike many high-yield accounts that can have restrictive terms, Apple allows deposits of up to $250,000, offering security and peace of mind. Furthermore, users can easily track their Daily Cash and savings progress in one place, making it easier than ever to manage personal finances.

The appeal of high-yield savings accounts extends beyond just interest rates; they represent a smart choice in a financial landscape where maximizing returns on even small amounts of money can lead to significant gains over time. Apple Card users now have the opportunity to take full advantage of this, elevating their financial strategy within the trusted Apple brand.

Apple Card Daily Cash: A New Way to Earn Rewards

With the Apple Card, users earn Daily Cash on their purchases, a feature that has not only incentivized spending through rewards but also created a simple mechanism for saving through the new high-yield savings account. Daily Cash rewards can be deposited into the savings account, allowing users to give new life to their cashback earnings. Rather than allowing this money to sit idle in a regular checking account, the high-yield option transforms it into a potent savings mechanism.

This integration of Daily Cash with a high-yield savings account is a strategic move by Apple that enhances user engagement with its financial ecosystem. Not only does it encourage users to use their Apple Card more often to maximize their rewards, but it also provides an opportunity to grow those rewards through investment in a high-interest account. This synergy between spending and saving perfectly aligns with the growing trend of consumers seeking more robust banking solutions that optimize their financial health.

Comparing Interest Rates: Apple vs Traditional Banks

When evaluating the Apple Card savings account with its striking 4.15% APY against traditional banks, the disparity becomes glaringly evident. Most banks, such as Bank of America, offer interest rates that are nominal at best. This stark contrast makes Apple’s offering not just compelling, but a strategic decision for savers looking to maximize their returns. Regularly, consumers are searching for the best savings accounts, and Apple’s entry into the market provides a potent alternative that could challenge established players.

Furthermore, the ease of transferring Daily Cash into this high-yield savings account directly from the Wallet app streamlines the process of earning interest. Traditional banking systems often come with complicated procedures for transferring funds or high minimum balances, but Apple simplifies this, ensuring that users can quickly put their hard-earned cashback to work. Such comparisons highlight why many individuals are considering switching their savings strategies amid a saturated market.

Why Choose the Apple Card Savings Account?

Choosing the Apple Card savings account represents more than just an opportunity to earn a higher interest rate; it symbolizes a shift towards utilizing digital financial services that cater to the modern consumer. With Apple’s reputation for innovation and user-friendly technology, this savings account aligns perfectly with those looking to adopt a holistic approach to their finances. By opting for this account, users can easily keep track of their Apple Card purchases and savings all in one digital location.

In addition, Apple continuously enhances its financial offerings, making it likely that the features of the Apple Card savings account will evolve over time. Users can expect ongoing updates and improvements, ensuring they remain at the forefront of the latest financial tools and technology. Taking advantage of the Apple Card savings account isn’t just about securing good interest rates; it’s about joining a forward-thinking financial community.

Easily Manage Your Savings With Apple

Managing personal finances can be daunting, but the Apple Card savings account offers a simplified approach through the Wallet app. Users can effortlessly monitor their Daily Cash earnings, check their savings balance, and manage deposits with just a few taps on their iPhone. This user-friendly interface promotes a more engaged relationship with personal finance, encouraging users to take charge of their financial wellbeing.

Moreover, the convenience of being able to access and manage savings directly from a trusted platform like Apple further strengthens the user experience. By eliminating the barriers associated with traditional banking—such as lengthy processes and cumbersome apps—Apple positions itself as a leader in integrated financial solutions. Users are more likely to save and invest wisely when the tools are easily accessible, straightforward, and within a familiar environment.

Apple’s Financial Services Expansion: The Bigger Picture

The introduction of the high-yield savings account is just the latest chapter in Apple’s expansive foray into financial services. This move solidifies Apple’s commitment to not only providing consumer electronics but also enabling healthier financial practices among its users. By offering products that work in tandem, such as the Apple Card and its savings account, Apple is pioneering a model where technology and finance seamlessly intersect.

This trend represents a significant shift in how consumers interact with their finances, providing them with sophisticated tools that encourage better money management. The addition of services like ‘buy now, pay later’ and high-yield savings reflects an understanding of modern consumer needs, positioning Apple as a formidable player against traditional financial institutions. As Apple continues to innovate in the space, users can expect more features that prioritize convenience and growth.

What Users Are Saying About the New Savings Account

Feedback from users regarding the new Apple Card savings account has been overwhelmingly positive. Many appreciate the high interest rate and the fact that their Daily Cash can be put to work immediately in a high-yield environment. Users have lauded the simplification of saving money, commenting on how easy it is to transition their cashback directly into savings without any additional hurdles.

Moreover, early adopters highlight the convenience factors—especially the integration with the Wallet app. Users express satisfaction in having a single platform to manage all their transactions and savings, which aligns with current desires for cohesiveness in financial management solutions. As word spreads about the benefits of the Apple Card savings account, more potential users may consider shifting their financial habits to take advantage of Apple’s impressive offerings.

The Future of Savings with Apple Card

As Apple continues to innovate, the future of savings with the Apple Card looks promising. The 4.15% APY is not just an introductory offer but sets a precedent for the potential growth of such financial products in the market. As more consumers recognize the benefits of migrating their savings to high-yield accounts, Apple’s timely intervention could reshape how users perceive banking and savings.

Looking ahead, Apple may introduce even more integrated financial products that work seamlessly together to provide further incentives for saving and financial health. With the ongoing trend towards digitization, the ability to manage savings, spending, and even investment from a single platform, such as the Wallet app, could shape the future landscape of personal finance in profound ways.

Frequently Asked Questions

What is the interest rate on the Apple Card savings account?

The Apple Card savings account offers a competitive annual percentage yield (APY) of 4.15%, which is significantly higher than what most traditional banks provide, such as Bank of America, which only offers 0.01% APY.

How does the Apple Card Daily Cash work with the savings account?

With the Apple Card savings account, you can automatically deposit your Apple Card Daily Cash rewards into your high-yield savings account, allowing your cashback rewards to grow with interest.

What are the benefits of using the Apple Card high-yield savings account?

The main benefits of the Apple Card high-yield savings account include a high APY of 4.15%, seamless integration with your Apple Wallet, and the ability to transfer money directly from your bank account, enabling you to maximize your savings.

Can I transfer funds to my Apple Card savings account from other banks?

Yes, you can transfer funds directly from your existing bank account to your Apple Card high-yield savings account, allowing you to easily manage and grow your savings without hassle.

What is the maximum amount I can deposit into my Apple Card savings account?

You can deposit up to $250,000 into your Apple Card high-yield savings account, providing ample room for significant savings growth.

Is the Apple Card savings account available to all users?

Currently, the Apple Card savings account feature is only available for users in the United States. Make sure your Apple Card is set up and updated to access this feature.

How does the Apple Card savings account compare with other savings accounts?

When comparing savings accounts, the Apple Card savings account offers a higher APY of 4.15%, making it a strong choice compared to other banks that provide much lower interest rates.

Is the interest rate on the Apple Card savings account fixed?

The interest rate on the Apple Card savings account is variable, meaning it can change at any time based on Apple’s policies and market conditions.

What are the main features of Apple financial services related to the savings account?

Apple financial services related to the savings account include easy access through the Wallet app, direct deposit of Daily Cash, and competitive interest rates, all designed to promote better financial health for users.

How can I access my Apple Card savings account?

You can access your Apple Card high-yield savings account through the Apple Wallet app on your iPhone, making it convenient to manage your funds.

| Feature | Description |

|---|---|

| Annual Percentage Yield (APY) | 4.15%, significantly higher than most traditional banks |

| Daily Cash Rewards | Users can save their Daily Cash rewards into the savings account |

| Account Funding | Users can transfer funds directly from their bank accounts up to $250,000 |

| Competition | Apple is competing with traditional banks and financial services like Klarna and Affirm |

| Availability | Currently only available in the United States |

| Goal | To help users lead healthier financial lives by integrating savings into their financial tools |

Summary

The Apple Card savings account introduces an innovative financial product aimed at enhancing the saving experience for Apple Card users. With an impressive interest rate of 4.15% APY, it stands out as a more rewarding option compared to traditional savings accounts offered by most banks. This seamless integration allows users to directly deposit their Daily Cash rewards, making it easy to save while enjoying the benefits of Apple Card. The flexibility of adding funds up to $250,000 further strengthens its appeal. As part of Apple’s broader strategy in financial services, the Apple Card savings account represents a significant step towards empowering users with better financial management tools.